EEO Statement

DEUTZ is an equal opportunity employer and considers all applicants for employment based on merit, competence, performance, and business needs. We do not discriminate on the bases of any status protected under federal, state, or local law. Applicants will be considered regardless of their race, color, sex, gender identity or expression, age, religion, creed, national origin, citizenship status, sexual orientation, genetic information, physical or mental disability, military status or any other characteristic protected under federal, state, or local law. In addition to complying with all applicable laws, DEUTZ also has a strong corporate commitment to inclusion.

Norcross, Georgia, US

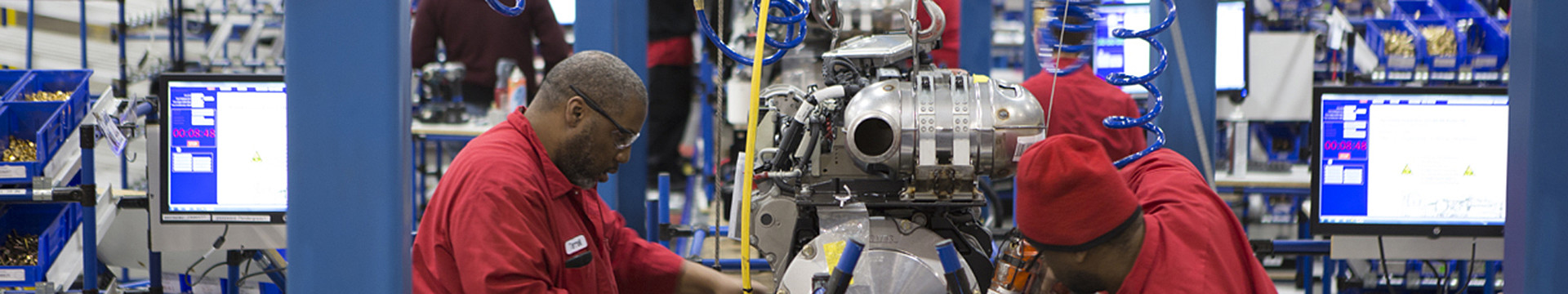

DEUTZ is one of the world’s leading manufacturers of innovative drive systems. Its core competences are the development, production, distribution and servicing of diesel, gas and electric drivetrains for professional applications that is used in construction equipment, agricultural machinery, material handling equipment, stationary equipment, commercial vehicles, rail vehicles and other applications.

Job Summary

POSITION SUMMARY:

The Tax Manager is responsible for assisting with the preparation and or review of income tax provisions, income tax compliance, miscellaneous filings, tax account reconciliations and journal entries. The position will work closely with the Accounting team on tax related projects.

ESSENTIAL DUTIES & RESPONSIBILITIES:

The Tax Manager will be responsible for, but not limited to, the following duties:

-

Coordinate with external service providers (tax consulting firms)

-

Review and/or prepare tax provision schedules, returns, payments, and reports

-

Identify tax solutions to complicated tax issues or errors from incorrect tax filings

-

Prepare property tax returns for all locations.

-

Identify legal tax savings and recommend ways to improve profits.

-

Work closely with Tax Department and colleagues in Germany

-

Ensure compliance with federal, state and local tax regulations

-

Advise management about the impact of tax liabilities and corporate strategies or new tax laws

-

Preparation of tax calculations (actual and deferred taxes) for annual and quarterly financial statements as well as for forecast purposes

-

Manage sales and use tax exemption certificates

-

Maintain tax calendar for Company filing obligations

-

Prepare journal entries for tax accruals, refunds, adjustments, or other required accounting transactions adhering to strict deadlines, reconcile tax general ledger accounts and ensure reconciling items are fully documented and resolved

-

Collaboration in the implementation of strategic projects (e.g. restructuring, M&A)

-

Collaborate with other accountants and financial staff in the company to provide support to executives and department heads who establish goals and budgets for the organization

-

Introduce new processes within tax preparation/review.

-

Other duties as assigned.

Supervisory Responsibilities: None

Travel Demands: Anticipated domestic and international travel is approximately 0-10% depending on business needs.

QUALIFICATIONS:

To perform this job successfully, an individual must be able to perform each essential duty satisfactorily. The requirements listed below represent the knowledge, skill, and ability required. Reasonable accommodations may be made to enable individuals with disabilities to perform essential functions.

EDUCATION/EXPERIENCE:

|

Required |

Preferred |

Description |

||

|

X |

|

5+ years in overall tax compliance and planning |

||

|

X |

|

Experience with tax software and tools (e.g. Sabrix) |

||

|

X |

|

3+ years of indirect tax compliance and filing experience |

||

|

X |

|

Financial Statements and Accounting skills |

||

|

X |

|

Bachelor’s degree required in Accounting, Finance, or related field |

||

|

|

X |

Experience with SAP |

||

|

|

X |

CPA certification or equivalent |

||

|

|

|

|

||

|

|

|

|

|

|

ADDITIONAL REQUIRED SKILLS:

-

Computer literacy, MS Excel in particular (familiarity with VLOOKUPs and pivot tables)

-

Effective and professional oral and written communication skills

-

Attention to detail and strong analytical skills

LANGUAGE ABILITY:

Read and interpret documents such as safety rules, operating and maintenance instructions, and procedure manuals. Write routine reports and correspondence. Speak effectively before groups of customers or employees.

MATHEMATICAL ABILITY:

Calculate figures and amounts such as discounts, interest, commissions, proportions, percentages, area, circumference and volume. Apply concepts of basic algebra and geometry.

REASONING ABILITY:

Define problems, collect data, establish facts and draw valid conclusions. Interpret an extensive variety of technical instructions in mathematical or diagram form and deal with several abstract and concrete variables.

WORK ENVIRONMENT:

The work environment characteristics described here represent those an employee encounter while performing the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform essential functions.

-

While performing the duties of this job, the employee is in an office. The noise level in the work environment is usually quiet to moderate.

PHYSICAL DEMANDS:

An employee must meet the physical demands described here to perform the essential functions of this job successfully. Reasonable accommodations may be made to enable individuals with disabilities to perform essential functions.

|

Physical Demand Requirement |

Frequency |

|

Concentration |

Daily |

|

Sitting |

Daily |

|

Communication |

Daily |

|

Vision |

Daily |

|

Verbal |

Daily |

|

Standing |

Daily |

|

Hearing/Listening |

Daily |

|

Lifting |

Daily |

|

Bending |

Daily |

|

|

|

The above job description is not intended to be an all-inclusive list of duties and standards of the position. Incumbents will follow any other instructions, and perform any related duties, as assigned by their supervisor.