EEO Statement

DEUTZ is an equal opportunity employer and considers all applicants for employment based on merit, competence, performance, and business needs. We do not discriminate on the bases of any status protected under federal, state, or local law. Applicants will be considered regardless of their race, color, sex, gender identity or expression, age, religion, creed, national origin, citizenship status, sexual orientation, genetic information, physical or mental disability, military status or any other characteristic protected under federal, state, or local law. In addition to complying with all applicable laws, DEUTZ also has a strong corporate commitment to inclusion.

Norcross, Georgia, US

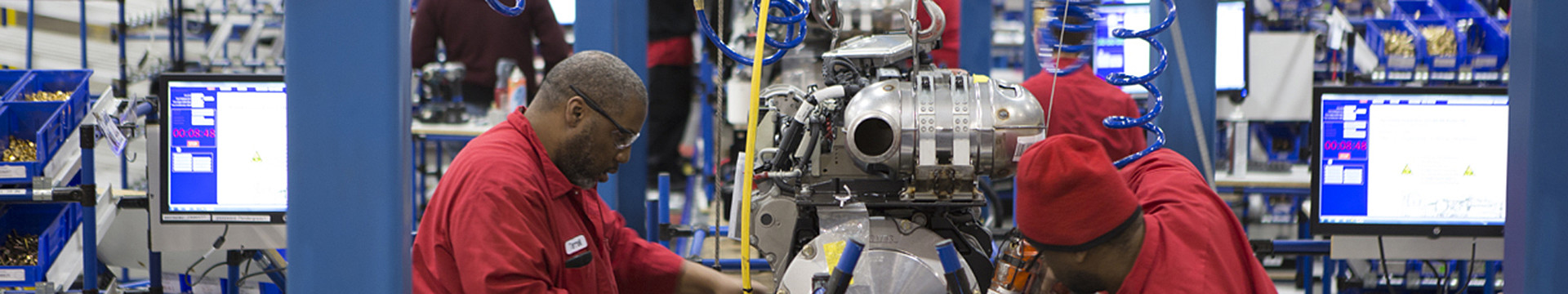

DEUTZ is one of the world’s leading manufacturers of innovative drive systems. Its core competences are the development, production, distribution and servicing of diesel, gas and electric drivetrains for professional applications that is used in construction equipment, agricultural machinery, material handling equipment, stationary equipment, commercial vehicles, rail vehicles and other applications.

Job Summary

Position Summary

As a Merger and Acquisition Analyst, you will play a key role in supporting the strategic initiatives of the company, particularly in identifying and evaluating potential mergers, acquisitions, joint ventures, and other strategic partnerships. You will be directly involved in analyzing market trends, conducting financial modeling, performing due diligence, and providing insights to senior leadership to drive our growth strategy in the highly competitive diesel engine manufacturing industry.

Essential Duties and Responsibilities

- Deal Sourcing & Market Research:

- Assist in identifying potential acquisition targets, strategic partnerships, and joint ventures within the diesel engine and related industries (e.g., automotive, industrial machinery, renewable energy sectors). Conduct market research and competitive analysis to identify emerging trends and potential opportunities.

- Financial Modeling & Valuation:

- Develop detailed financial models to evaluate potential targets, including discounted cash flow (DCF) analysis, comparable company analysis, precedent transactions, and accretion/dilution analysis. Assess target company financials to ensure alignment with strategic goals.

- Due Diligence:

- Assist in the due diligence process by gathering and analyzing financial, operational, and legal documents. Coordinate with internal and external teams (e.g., legal, tax, finance) to assess risks and validate assumptions. Prepare reports summarizing findings for senior management.

- Strategic Analysis & Reporting:

- Prepare presentations and reports for senior management, including investment committee presentations, strategic recommendations, and post-deal integration planning. Provide insights into market conditions, competitive landscape, and key financial metrics of potential targets.

- Integration Support:

- Work with cross-functional teams to ensure smooth integration of acquired companies. Monitor post-deal performance and contribute to operational and strategic initiatives.

- Industry Expertise:

- Develop an understanding of the diesel engine manufacturing market and related industries, including trends in energy transition, regulatory changes, technological advancements, and supply chain dynamics.

- Other Duties as Assigned

Other Attributes

- Strong analytical and financial modeling skills (Excel proficiency).

- Solid understanding of corporate finance, valuation techniques, and M&A processes.

- Ability to communicate complex financial information to non-financial stakeholders.

- Excellent research and problem-solving abilities.

- Strong attention to detail and organizational skills.

- High level of proficiency with Microsoft Office Suite (Excel, PowerPoint, Word).

- Team player with the ability to work collaboratively in a fast-paced environment.

- Strong work ethic with the ability to prioritize and manage multiple projects simultaneously.

- Self-starter.

Supervisory Responsibility

Individual Contributor

Travel Requirements

Anticipate domestic travel up to 20%

Minimum Requirements

- Bachelor’s degree in Finance, Economics, Business Administration, or a related field. MBA or relevant graduate education is a plus.

- 1-3 years of experience in investment banking, corporate finance, M&A advisory, management consulting, or similar roles. Experience in industrial manufacturing, automotive, or energy sectors is a plus.

Preferred Requirements

- Previous experience in engine service industry.

Physical Requirements:

- Prolonged periods of sitting at a desk and working on a computer

- Must be able to lift up to 15 pounds at a time.